West Berlin Nj Property Tax Rate . taxes due icon for calendar. Which nj county has the highest property tax rate? search our database of free west berlin residential property records including owner names, property tax assessments &. property taxes are calculated by multiplying your total current year assessment by the current tax year tax rate. the average property tax rate in nj is 2.557. Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average tax bill sitting at. applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. We used effective tax rate. Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782.

from www.landsat.com

property taxes are calculated by multiplying your total current year assessment by the current tax year tax rate. the average property tax rate in nj is 2.557. search our database of free west berlin residential property records including owner names, property tax assessments &. Which nj county has the highest property tax rate? Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. taxes due icon for calendar. Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average tax bill sitting at. We used effective tax rate. applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year.

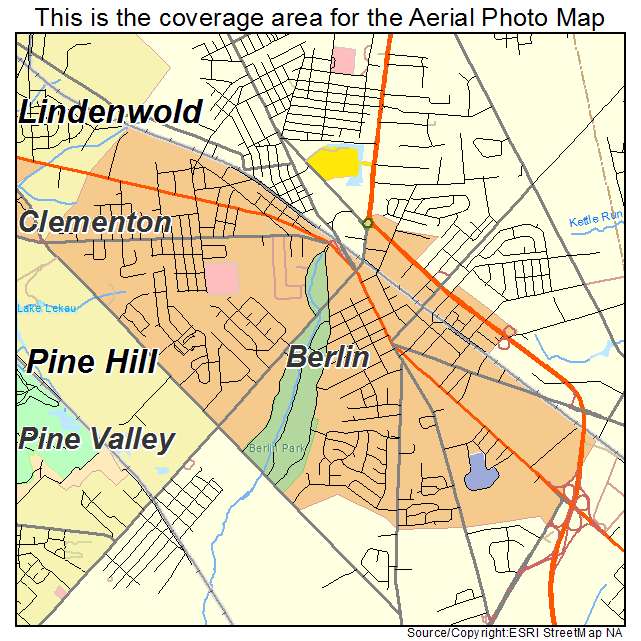

Aerial Photography Map of Berlin, NJ New Jersey

West Berlin Nj Property Tax Rate We used effective tax rate. property taxes are calculated by multiplying your total current year assessment by the current tax year tax rate. We used effective tax rate. search our database of free west berlin residential property records including owner names, property tax assessments &. Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average tax bill sitting at. Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. Which nj county has the highest property tax rate? taxes due icon for calendar. the average property tax rate in nj is 2.557. applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year.

From cechzuey.blob.core.windows.net

Most Expensive Property Taxes In Nj at Lillian Leon blog West Berlin Nj Property Tax Rate Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. the average property tax rate in nj is 2.557. Which nj county has the highest property tax rate? search our database of free west berlin residential property records including owner names, property tax assessments &. taxes due icon. West Berlin Nj Property Tax Rate.

From bserlin.blogspot.com

West Berlin Nj Real Estate BSERLIN West Berlin Nj Property Tax Rate applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. taxes due icon for calendar. Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. search our database of free west berlin residential property records including owner names,. West Berlin Nj Property Tax Rate.

From www.zillow.com

311 Toomer Ave, West Berlin, NJ 08091 Zillow West Berlin Nj Property Tax Rate Which nj county has the highest property tax rate? taxes due icon for calendar. search our database of free west berlin residential property records including owner names, property tax assessments &. Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. the average property tax rate in nj. West Berlin Nj Property Tax Rate.

From www.realtor.com

415 New Jersey 73 N, West Berlin, NJ 08091 West Berlin Nj Property Tax Rate applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. property taxes are calculated by multiplying your total current year assessment by the current tax year tax rate. search our database of free west berlin residential property records including owner names, property tax assessments &. the. West Berlin Nj Property Tax Rate.

From www.marketwatch.com

Want to see how America is changing? Property taxes hold the answer West Berlin Nj Property Tax Rate We used effective tax rate. Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. Which nj county has the highest property tax rate? Property taxes in berlin borough normally. West Berlin Nj Property Tax Rate.

From www.estately.com

231 Haddon Ave, WEST BERLIN, NJ 08091 Estately 🧡 MLS NJCD2064608 West Berlin Nj Property Tax Rate Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. search our database of free west berlin residential property records including owner names, property tax assessments &. property taxes are calculated by multiplying your total current year assessment by the current tax year tax rate. We used effective tax. West Berlin Nj Property Tax Rate.

From rowqvinnie.pages.dev

When Is Property Tax Due For 2024 Prudi Carlotta West Berlin Nj Property Tax Rate search our database of free west berlin residential property records including owner names, property tax assessments &. taxes due icon for calendar. Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. the average property tax rate in nj is 2.557. Property taxes in berlin borough normally range. West Berlin Nj Property Tax Rate.

From cebibezj.blob.core.windows.net

Nj Counties With Lowest Property Taxes at Robert Hodges blog West Berlin Nj Property Tax Rate the average property tax rate in nj is 2.557. applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. Which nj county has the highest property tax rate? property taxes are calculated by multiplying your total current year assessment by the current tax year tax rate. Property. West Berlin Nj Property Tax Rate.

From exopphgps.blob.core.windows.net

Property Taxes Berlin Ct at Norma Runnels blog West Berlin Nj Property Tax Rate the average property tax rate in nj is 2.557. search our database of free west berlin residential property records including owner names, property tax assessments &. Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average tax bill sitting at. We used effective tax rate. Which nj county has the highest property tax rate?. West Berlin Nj Property Tax Rate.

From itep.org

New Jersey Who Pays? 6th Edition ITEP West Berlin Nj Property Tax Rate taxes due icon for calendar. property taxes are calculated by multiplying your total current year assessment by the current tax year tax rate. Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. We used effective tax rate. the average property tax rate in nj is 2.557. Property. West Berlin Nj Property Tax Rate.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation West Berlin Nj Property Tax Rate applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. taxes due icon for calendar. search our database of free west berlin residential property records including owner names, property tax assessments &. We used effective tax rate. property taxes are calculated by multiplying your total current. West Berlin Nj Property Tax Rate.

From rosecommercial.com

Sale of 38,928+/ SF Industrial Property, West Berlin, NJ Rose West Berlin Nj Property Tax Rate Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average tax bill sitting at. search our database of free west berlin residential property records including owner names, property tax assessments &. Which nj county has the highest property tax rate? the average property tax rate in nj is 2.557. We used effective tax rate.. West Berlin Nj Property Tax Rate.

From www.attomdata.com

Property Taxes on SingleFamily Homes Rise Across U.S. in 2021 ATTOM West Berlin Nj Property Tax Rate taxes due icon for calendar. We used effective tax rate. Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average tax bill sitting at. the average property tax rate in nj is 2.557. applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year.. West Berlin Nj Property Tax Rate.

From www.trulia.com

223 Taunton Ave, West Berlin, NJ 08091 See Est. Value, Schools & More West Berlin Nj Property Tax Rate the average property tax rate in nj is 2.557. Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. We used effective tax rate. property taxes are calculated. West Berlin Nj Property Tax Rate.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today West Berlin Nj Property Tax Rate search our database of free west berlin residential property records including owner names, property tax assessments &. Which nj county has the highest property tax rate? Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average. West Berlin Nj Property Tax Rate.

From www.trulia.com

221 Clarence Ave, West Berlin, NJ 08091 Trulia West Berlin Nj Property Tax Rate Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average tax bill sitting at. search our database of free west berlin residential property records including owner names, property tax assessments &. applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. Which nj county. West Berlin Nj Property Tax Rate.

From www.njpp.org

Reforming New Jersey’s Tax Would Help Build Shared Prosperity West Berlin Nj Property Tax Rate applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year. property taxes are calculated by multiplying your total current year assessment by the current tax year tax rate. Property taxes in berlin borough normally range from $5,750 to ~$8,650, with the average tax bill sitting at. Which nj. West Berlin Nj Property Tax Rate.

From www.bexrealty.com

164 Piedmont Blvd, West Berlin, NJ 08091 MLS NJCD2017572 BEX Realty West Berlin Nj Property Tax Rate Which nj county has the highest property tax rate? Property taxes in west berlin normally range from ~$10,750 to $15,200, with the average tax bill sitting at $11,782. search our database of free west berlin residential property records including owner names, property tax assessments &. applicant must meet certain income limits for both the “base year” (year applicant. West Berlin Nj Property Tax Rate.